2018 Tax Reform: Major Provisions Affecting Current & Prospective Homeowners

2018 is here! May Group Realtors with RE/MAX of Grand Rapids are here to help with any new tax law questions you might have in regards to buying or selling your home.

The new tax law provides generally lower taxes for all individual tax filers. While this does not mean that every American will pay lower taxes under these changes, many will. The total size of the tax cut from the rate reductions equals more than $1.2 trillion over ten years.

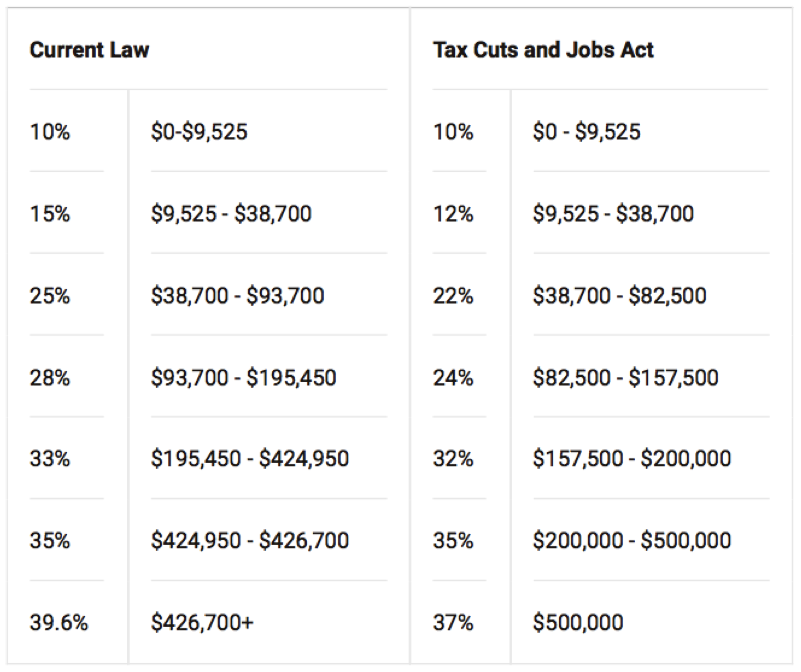

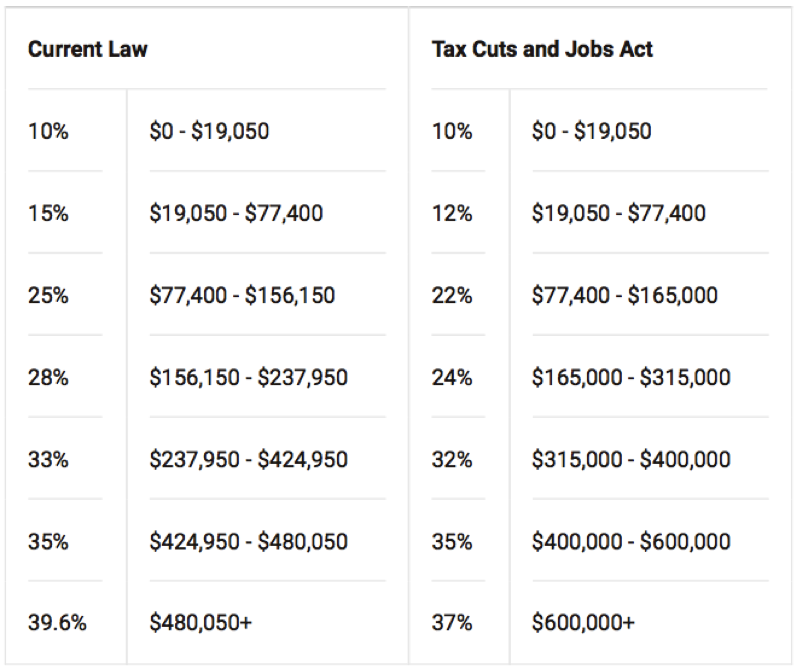

The tax rate schedule retains seven brackets with slightly lower marginal rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The final bill retains the current-law maximum rates on net capital gains (generally, 15% maximum rate but 20% for those in the highest tax bracket; 25% rate on “recapture” of depreciation from real property)

Tax Brackets for Ordinary Income Under Current Law & the Tax Cuts and Jobs Act (2018 Tax Year) Single Filer

Tax Brackets, Ordinary Income Under Current Law & the Tax Cuts & Jobs Act (2018 Tax Year) Married Filing Jointly

Exclusion of Gain on Sale of a Principal Residence

The final bill retains current law. A significant victory in the final bill that NAR achieved. The Senate-passed bill would have changed the amount of time a homeowner must live in their home to qualify for the capital gains exclusion from 2 out of the past 5 years to 5 out of the past 8 years. The House bill would have made this same change as well as phased out the exclusion for taxpayers with incomes above $250,000 single/$500,000 married.

Mortgage Interest Deduction

The final bill reduces the limit on deductible mortgage debt to $750,000 for new loans taken out after 12/14/17. Current loans of up to $1 million are grandfathered and are not subject to the new $750,000 cap. Neither limit is indexed for inflation.

Homeowners may refinance mortgage debts existing on 12/14/17 up to $1 million and still deduct the interest, so long as the new loan does not exceed the amount of the mortgage being refinanced.

The final bill repeals the deduction for interest paid on home equity debt through 12/31/25. Interest is still deductible on home equity loans (or second mortgages) if the proceeds are used to substantially improve the residence.

Interest remains deductible on second homes, but subject to the $1 million / $750,000 limits.

The House-passed bill would have capped the mortgage interest limit at $500,000 and eliminated the deduction for second homes.

Deduction for State and Local Taxes

The final bill allows an itemized deduction of up to $10,000 for the total of state and local property taxes and income or sales taxes. This $10,000 limit applies for both single and married filers and is not indexed for inflation.

The final bill also specifically precludes the deduction of 2018 state and local income taxes prepaid in 2017.

When House and Senate bills were first introduced, the deduction for state and local taxes would have been completely eliminated. The House and Senate passed bills would have allowed property taxes to be deducted up to $10,000. The final bill, while less beneficial than current law, represents a significant improvement over the original proposals.

Standard Deduction

The final bill provides a standard deduction of $12,000 for single individuals and $24,000 for joint returns. The new standard deduction is indexed for inflation.

By doubling the standard deduction, Congress has greatly reduced the value of the mortgage interest and property tax deductions as tax incentives for homeownership. Congressional estimates indicate that only 5-8% of filers will now be eligible to claim the-se deductions by itemizing, meaning there will be no tax differential between renting and owning for more than 90% of taxpayers.

Repeal of Personal Exemptions

Under the prior law, tax filers could deduct $4,150 in 2018 for the filer and his or her spouse, if any, and for each dependent. These exemptions have been repealed in the new law.

This change alone greatly mitigates (and in some cases entirely eliminates) the positive aspects of the higher standard deduction.

Don’t forget, when you need help buying or selling your home in the greater Grand Rapids area, May Group Realtors is here to help! Read what our clients have to say about our exceptional service on our Zillow page here: https://www.zillow.com/profile/joshmay/#reviews